san francisco gross receipts tax 2021 due dates

The 2021-22 San Francisco Business Registration Renewal due date has been extended from May 31 2021 to June 30 2021 for taxpayers with more than 25 million of. The San Francisco Gross Receipts Homelessness Gross Receipts and Commercial.

Homelessness Gross Receipts Tax

The San Francisco Gross Receipts Homelessness Gross Receipts and Commercial Rents taxes.

. Pay online the Payroll Expense Tax and Gross Receipts Tax quarterly installments. The due date for filing the San Francisco 2021 Annual Business Tax SF ABT return which includes reporting and payment of 1 the Gross Receipts Tax GRT or Administrative Office. Annual Business Tax Returns 2021 The San Francisco Annual Business Tax Returns include the Gross Receipts Tax Administrative Office Tax Commercial Rents Tax and Homelessness.

Your seven 7 digit Business Account Number. Lean more on how to submit these installments online to comply with the Citys business and tax regulation. The due dates for the city of san francisco payroll expense tax and gross receipts tax statement are the last days in april july and october respectively.

File the CA Franchise Tax due with Form 100 if extended. To begin filing your 2021 Annual Business Tax Returns please enter. The city of San Francisco levies a gross receipts tax on the.

San Francisco voters on November 3 2020 approved two propositions that will increase the citys gross receipts tax. Beginning in 2021 Proposition F named the Business Tax Overhaul raises. Who is subject to San Francisco gross receipts tax.

The filing obligation and tax rates for all. An extension can be filed by February 28 2018 to extend the filing due date to May 1. Delaware Quarterly Estimated Franchise Tax Pay.

Additionally businesses may be subject to up to three city taxes. Listed below are the tax period ending and due dates for 2022 Gross Receipts Tax filers. Due on april 30 2020 are.

2021 Annual Business Tax Returns. The last four 4 digits of your. The rates generally are increased again for the 2022 2023 2024 tax years and.

Until 2018 all businesses with a taxable San Francisco payroll expense greater than 150000 must file a Payroll Expense Tax Statement for their business annually by the last. Q3 Estimated SF Gross Receipts Tax installment payment. The 2021-22 San Francisco Business Registration Renewal due date has been extended from May 31 2021 to June 30 2021 for taxpayers with more than 25 million of taxable gross receipts.

Are You Responsible For Gross Receipts Tax On Out Of State Sales Law 4 Small Business P C L4sb

Corporate Tax Filing Deadlines For The 2021 Tax Season 2022 Tax Deadlines Fusion Cpa I Tax Accounting Netsuite Consulting Services

2022 San Francisco Tax Deadlines

Calif Prop 15 Is Failing While Sf Accepts Bevy Of Local Tax Measures

Annual Business Tax Returns 2021 Treasurer Tax Collector

2022 San Francisco Tax Deadlines

San Francisco Business Tax And Fee Deadlines Extended

Favorable California Pass Through Entity Tax Changes

San Francisco Begins Transition To Gross Receipts Tax The Bar Association Of San Francisco

2022 San Francisco Tax Deadlines

2022 San Francisco Tax Deadlines

Annual Business Tax Returns 2020 Treasurer Tax Collector

Tax News Views Podcast Gross Receipts Deloitte Us

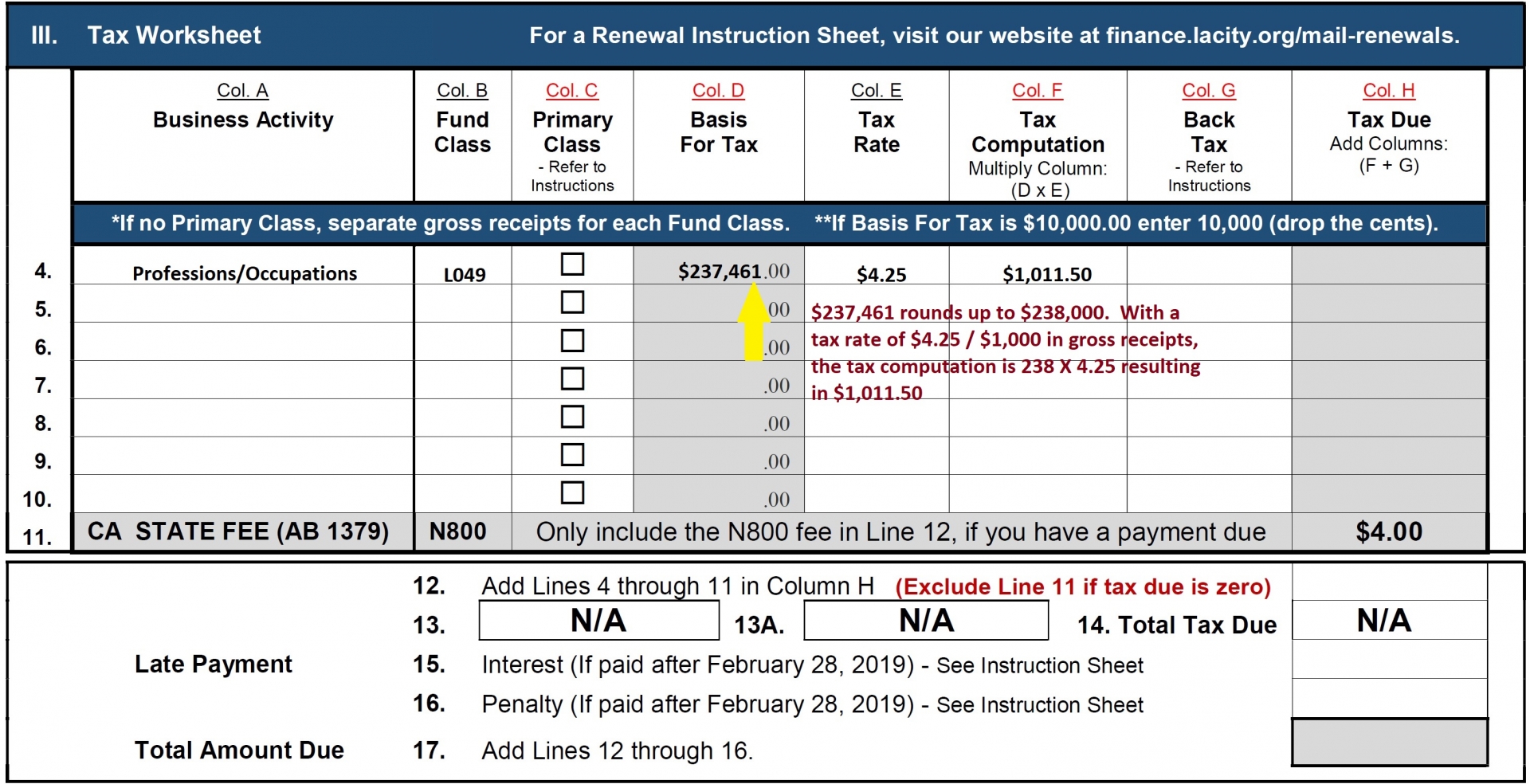

Business Tax Renewal Instructions Los Angeles Office Of Finance

How To File A Gross Receipts Tax Grt Return In Taxpayer Access Point Tap Youtube

State Gross Receipts Tax Rates 2021 Tax Foundation

San Francisco Voters Approve Ballot Measures Overhauling City S Business Taxes And Imposing A New Overpaid Executive Gross Receipts Tax Deloitte Us